What Is an Affordability Calculator?

An affordability calculator is a valuable financial tool designed to help you estimate how much home you can afford based on your income, expenses, and loan terms. Whether you're planning to buy your first home or evaluating your budget for a new mortgage, this calculator provides an easy way to assess your financial readiness for homeownership.

By entering details such as your monthly gross income, existing monthly debts, interest rate, loan term, down payment, and property tax rate, you can get a clear picture of your maximum affordable home price. The tool calculates your housing expenses and compares them to industry-standard debt-to-income (DTI) ratios to determine whether your scenario is financially viable.

Why Is It Important?

Understanding affordability before applying for a mortgage can save you from future financial stress. Lenders typically consider both your total DTI ratio and your housing-only DTI ratio when determining loan eligibility. This calculator helps you stay within those thresholds, increasing your chances of loan approval and ensuring sustainable financial health. It also helps you avoid looking at homes outside your budget, saving you time and emotional effort during the home-buying process.

The two key metrics evaluated are:

- Total DTI (Debt-to-Income): This is the percentage of your gross monthly income that goes towards paying your monthly debt payments. It includes your projected mortgage payment (principal, interest, property taxes, and insurance), credit card payments, car loans, student loans, and other regular debt obligations. Lenders use this to gauge your ability to manage monthly payments. A lower DTI indicates less risk to lenders.

- Housing DTI (also known as Front-End DTI or Housing Expense Ratio): This is the percentage of your gross monthly income that goes towards housing costs alone. It typically includes your projected mortgage payment (principal and interest), property taxes, and homeowners insurance. This ratio helps lenders understand if your proposed housing costs are reasonable given your income.

How to Use the Calculator

Simply fill out the fields with accurate information such as your income, existing debts, down payment amount, and desired loan term. The calculator will provide a detailed breakdown of your estimated maximum home price, monthly payments, and how your scenario fits within recommended DTI limits. A chart is also displayed for visual reference, breaking down your potential monthly housing costs.

This tool is meant for informational purposes only and does not guarantee loan approval. For a comprehensive analysis and personalized guidance tailored to your specific financial situation, consider consulting with a certified mortgage advisor or financial planner. Always ensure all your financial information is up-to-date for the most accurate results.

What You Need to Know About Home Affordability

Understanding what goes into determining how much home you can afford is crucial for a smooth and successful home-buying journey. Beyond just the purchase price, several factors influence your true affordability.

The Role of Your Credit Score

Your credit score plays a significant role in your mortgage approval and the interest rate you qualify for. Lenders use your credit score to assess your creditworthiness and your history of managing debt. A higher credit score (typically 740 and above) can lead to lower interest rates, which can drastically reduce your monthly payments and the total cost of your loan over its term. It's advisable to check your credit report and score well in advance of applying for a mortgage to address any discrepancies or improve your standing.

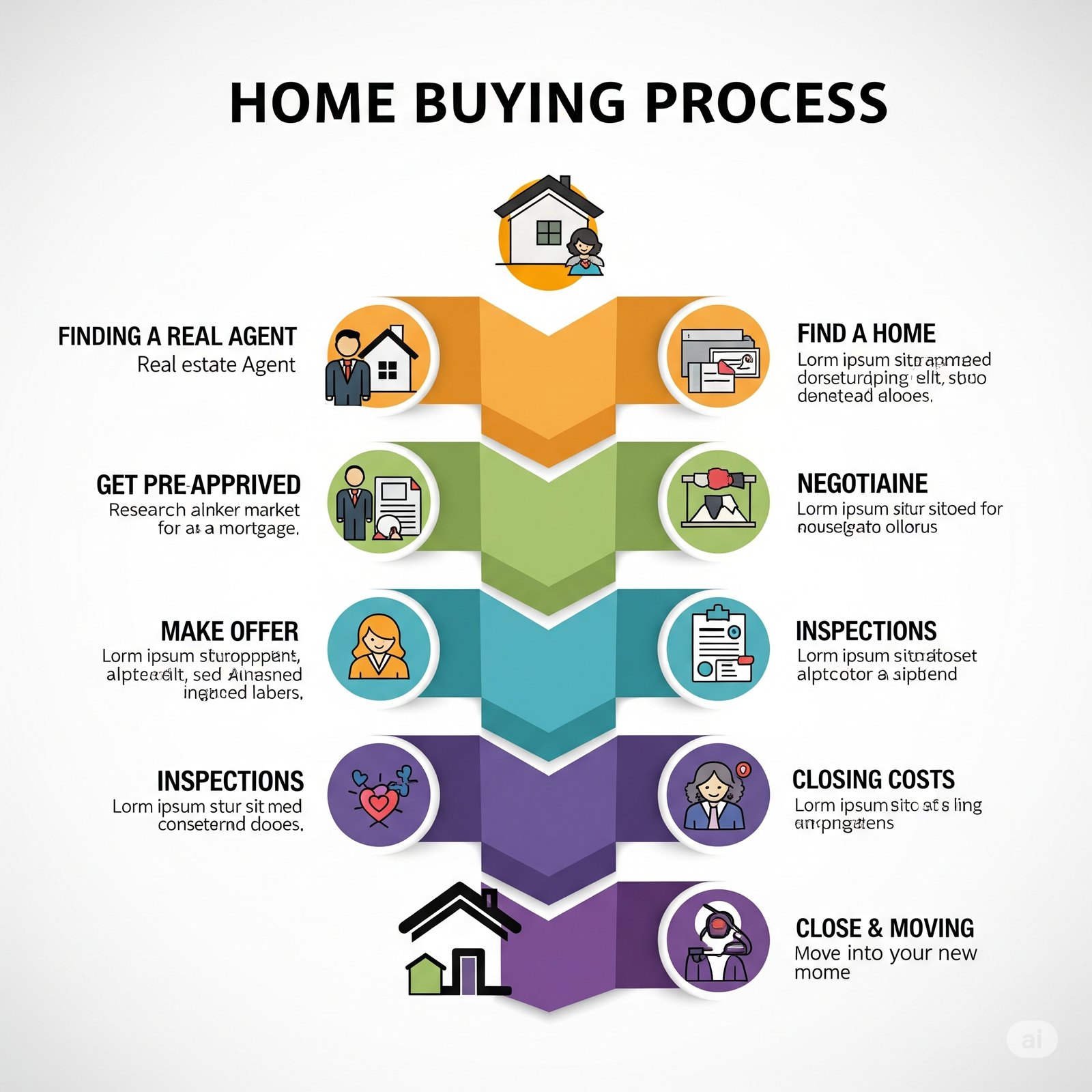

Steps in the Home Buying Process

The journey to homeownership involves several key stages:

- Financial Assessment: Use tools like this Affordability Calculator to understand your budget. Gather necessary financial documents.

- Mortgage Pre-Approval: Get pre-approved by a lender. This gives you a clear idea of how much you can borrow and shows sellers you're a serious buyer.

- Home Search: Work with a real estate agent to find homes that fit your budget and criteria.

- Making an Offer: Once you find the right home, your agent will help you make an offer.

- Appraisal and Inspection: The lender will order an appraisal to ensure the home's value, and you'll typically arrange for a home inspection.

- Underwriting: The lender reviews all your financial documents to finalize loan approval.

- Closing: You sign all the necessary paperwork, and the ownership of the home is transferred to you.

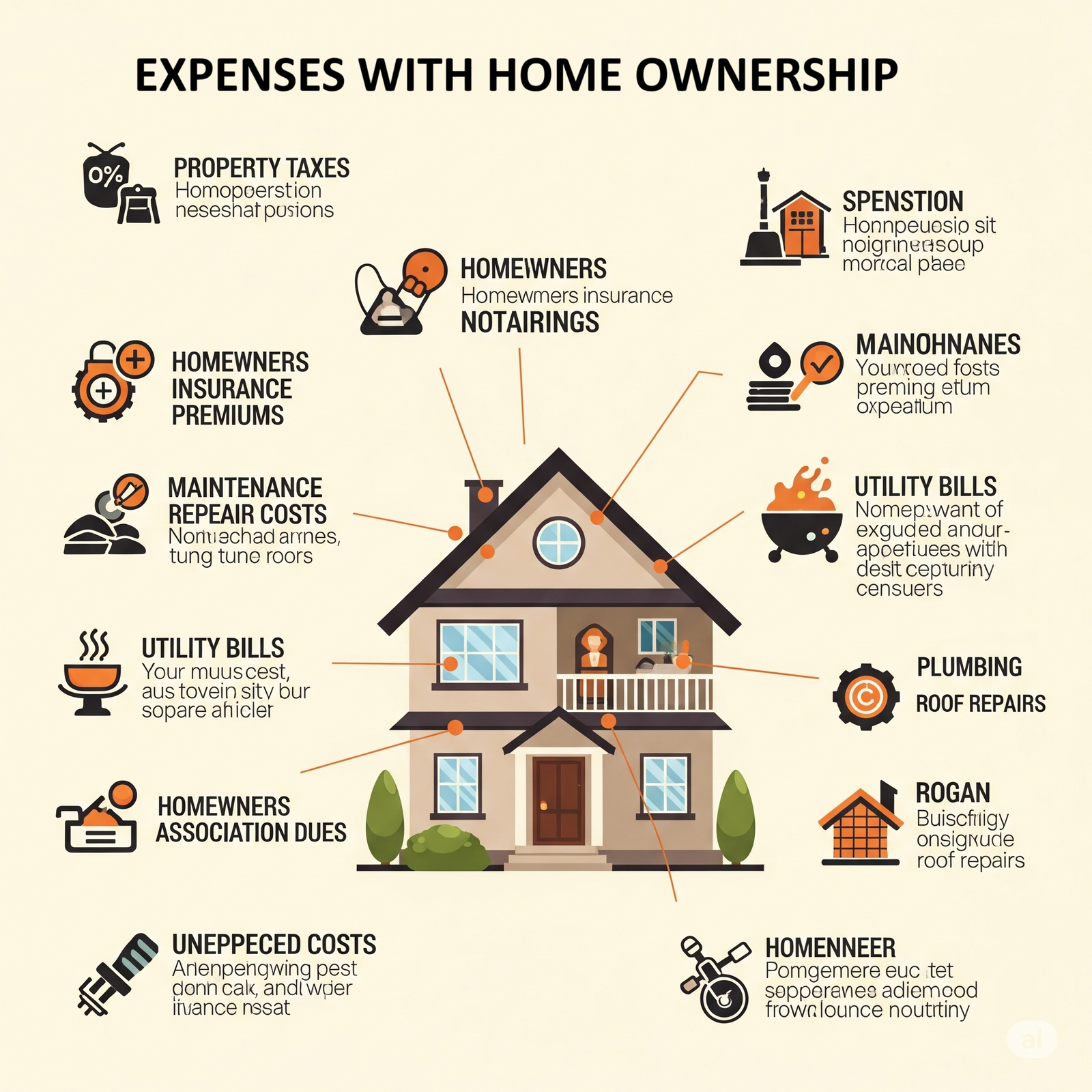

Beyond the Mortgage Payment: Understanding Additional Costs

When calculating your home affordability, it's vital to consider all associated costs, not just the principal and interest of your mortgage loan. These additional expenses can significantly impact your monthly budget and overall homeownership cost:

- Property Taxes: These are local government taxes based on your home's assessed value. They are often included in your monthly mortgage payment (escrow).

- Homeowners Insurance: Required by lenders, this protects your home from damage, theft, and liabilities. This is also typically escrowed.

- Private Mortgage Insurance (PMI): If your down payment is less than 20% of the home's purchase price, your lender will likely require PMI. This protects the lender, not you.

- Homeowners Association (HOA) Fees: If you buy a condo, townhouse, or home in a planned community, you'll likely pay monthly HOA fees for maintenance of common areas.

- Utilities: Beyond your current utility bills, remember that a new or larger home might have higher heating, cooling, water, and electricity costs.

- Maintenance and Repairs: Homes require ongoing maintenance. It's wise to budget at least 1-2% of your home's value annually for unforeseen repairs and regular upkeep.

- Closing Costs: These are fees paid at the closing of a real estate transaction, typically ranging from 2% to 5% of the loan amount. They include things like loan origination fees, appraisal fees, title insurance, and legal fees.

Factoring in these costs will give you a more realistic picture of your true monthly housing expenses and help prevent financial surprises.