Understanding Compound Interest

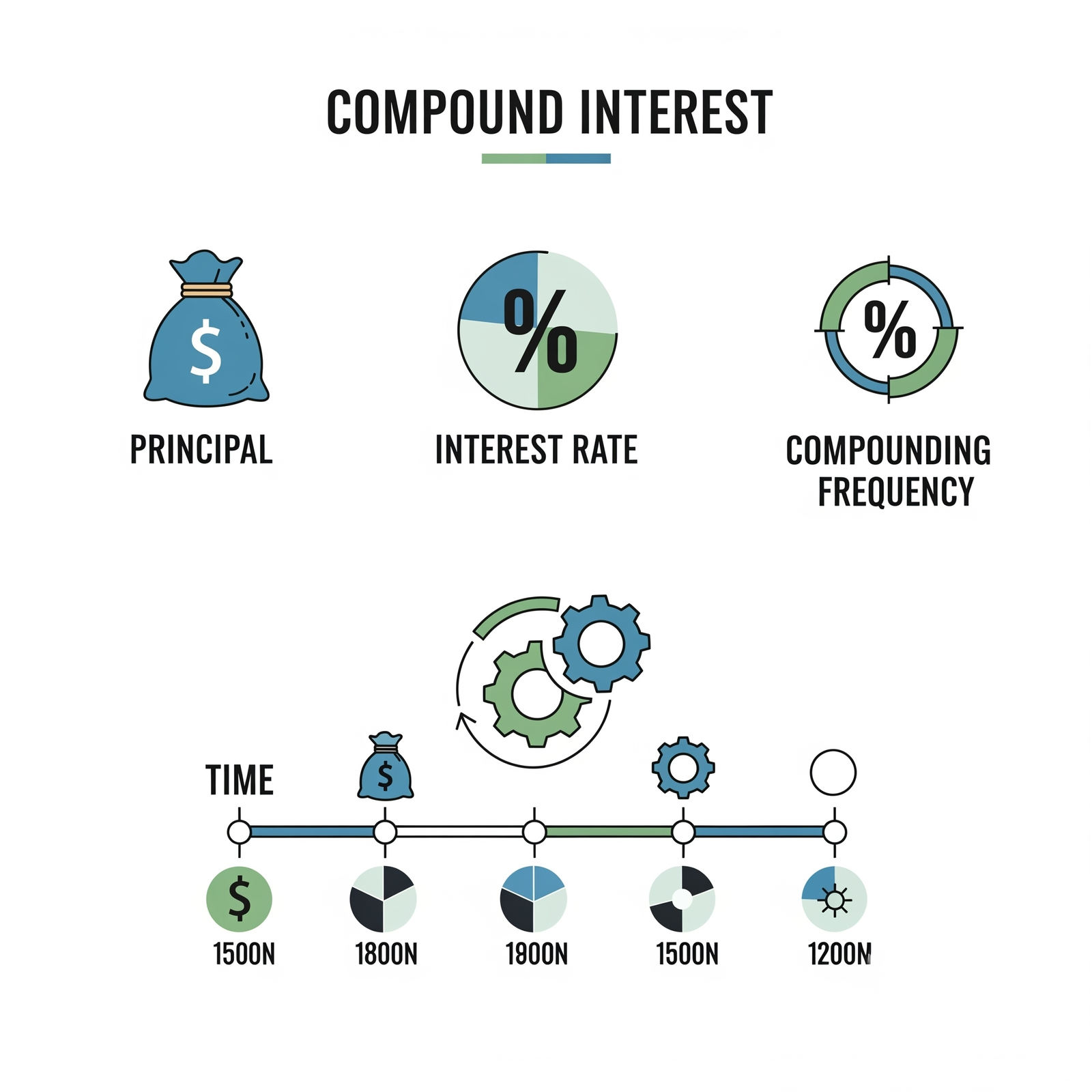

Compound interest is often referred to as the "eighth wonder of the world" or "interest on interest." It's the process by which an asset's earnings, from either capital gains or interest, are reinvested to generate additional earnings over time. This means that not only does your initial investment earn interest, but the interest you earn also begins to earn interest.

This powerful concept allows your money to grow at an accelerating rate, making it a cornerstone of long-term wealth building. Unlike simple interest, which is calculated only on the principal amount, compound interest continually adds the accumulated interest back to the principal for future calculations.

Visual representation of money growing through compound interest.

Visual representation of money growing through compound interest.

Simple Interest vs. Compound Interest

The key difference between simple and compound interest lies in how the interest is calculated:

- Simple Interest: Calculated only on the original principal amount. The interest earned remains constant over the investment period. Formula: $I = P \times R \times T$ (where I = Interest, P = Principal, R = Rate, T = Time).

- Compound Interest: Calculated on the initial principal and also on the accumulated interest from previous periods. This leads to exponential growth. The more frequently interest is compounded, the faster your money grows.

For example, if you invest $1,000 at 5% annual interest:

- With **simple interest**, you'd earn $50 each year ($1,000 * 0.05). After 10 years, you'd have $1,500.

- With **compound interest** (compounded annually), your interest in year two would be based on $1,050 (initial $1,000 + $50 interest from year one), leading to a higher total amount over time.

Maximizing the Power of Compound Interest

To truly leverage the potential of compound interest, consider these strategies:

- Start Early: Time is your biggest ally. The longer your money has to compound, the greater the returns. Even small investments made early can grow substantially.

- Invest Consistently: Regular contributions, even modest ones, add to your principal and accelerate compounding.

- Reinvest Earnings: Allow any interest or dividends earned to be reinvested into your principal. This is crucial for true compounding.

- Seek Higher Interest Rates: While not always possible, even a slight increase in your interest rate can have a significant impact over many years.

- Understand Compounding Frequency: More frequent compounding (e.g., daily vs. annually) will result in slightly higher returns because your interest starts earning interest sooner.

The importance of starting early and investing consistently for compounding.

The importance of starting early and investing consistently for compounding.