Auto Loan Calculator

Calculate your estimated monthly payments and total interest for a car loan, and view a detailed amortization schedule.

Understanding Your Auto Loan

An auto loan, or car loan, is a sum of money a borrower receives from a lender to purchase a vehicle. In exchange, the borrower agrees to repay the loan amount, plus interest, over a set period. This repayment typically occurs through fixed monthly installments. Auto loans are a common way for individuals to finance a new or used car when they don't have enough cash to buy it outright.

Understanding the components of an auto loan is crucial for making informed financial decisions. The main components are:

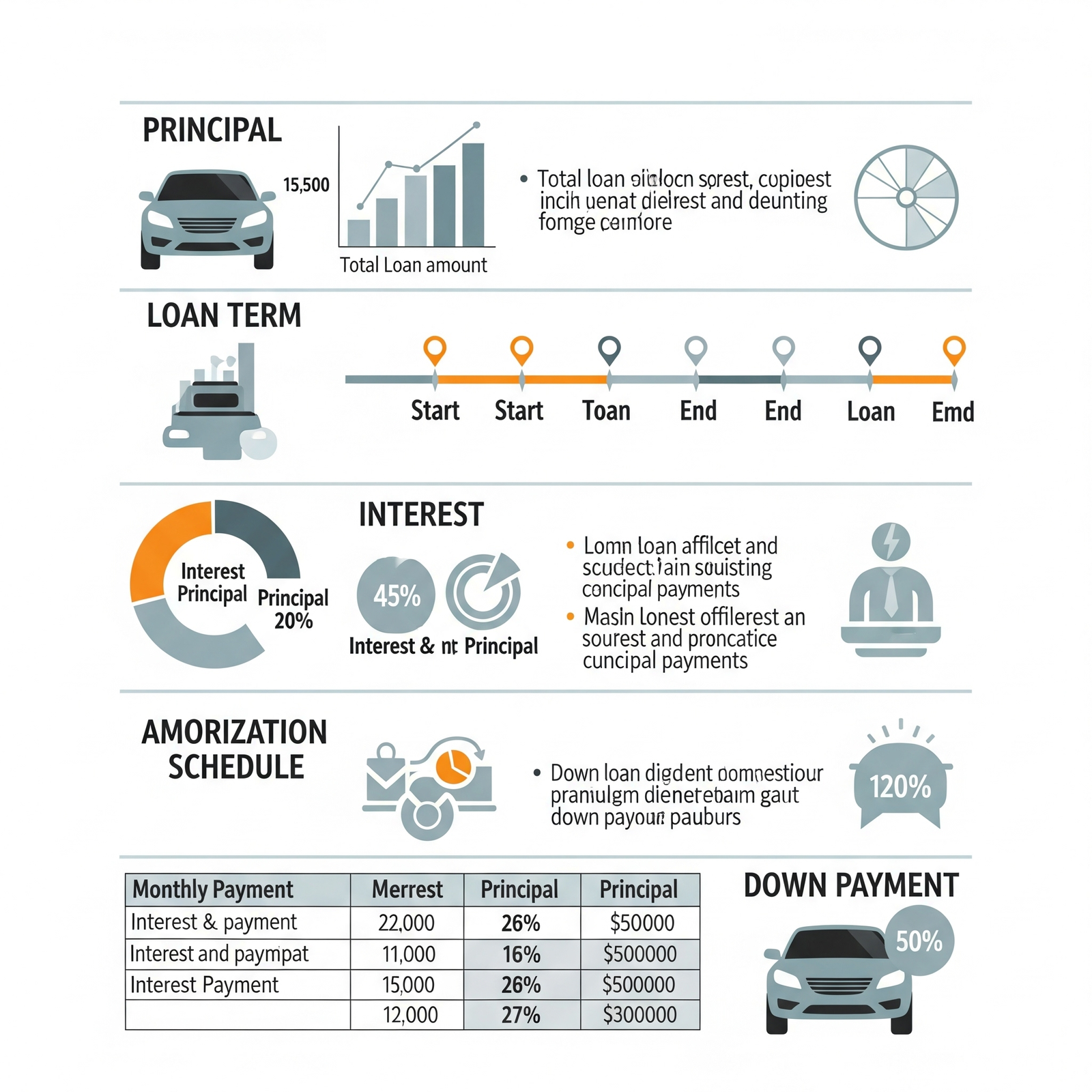

- Principal: The initial amount of money borrowed.

- Interest Rate: The cost of borrowing the principal, expressed as a percentage. A lower interest rate means lower monthly payments and less total cost over the life of the loan.

- Loan Term: The duration over which you agree to repay the loan, typically expressed in months or years. Longer terms usually mean lower monthly payments but higher total interest paid.

- Monthly Payment: The fixed amount you pay each month to cover both principal and interest.

- Total Interest Paid: The cumulative amount of interest paid over the entire loan term.

Our auto loan calculator helps you estimate these key figures, allowing you to compare different scenarios and choose a loan that fits your budget.

Factors Affecting Your Auto Loan

Several factors can influence the terms and cost of your auto loan:

- Credit Score: Your creditworthiness significantly impacts the interest rate you'll be offered. Borrowers with excellent credit typically qualify for the lowest rates.

- Loan Amount: The total amount you borrow directly affects your monthly payment and total interest. Consider your down payment to reduce the loan amount needed.

- Interest Rate (APR): This is the annual cost of the loan. Shop around with different lenders to find the most competitive rates.

- Loan Term: As mentioned, a shorter term means higher monthly payments but less interest, while a longer term offers lower payments but more overall interest.

- Down Payment: A larger down payment reduces the loan amount and can potentially lower your interest rate.

- Debt-to-Income Ratio (DTI): Lenders assess your DTI to determine your ability to manage additional debt. A lower DTI can lead to better loan terms.

- New vs. Used Car: Used cars often come with higher interest rates than new cars due to perceived higher risk, but their lower purchase price might still result in a lower total cost.

Key Terms in Auto Loans

- APR (Annual Percentage Rate)

- The true annual cost of borrowing, including the interest rate and certain fees. It provides a more comprehensive picture than the interest rate alone.

- Amortization Schedule

- A table detailing each monthly loan payment, showing how much goes towards paying off the principal versus interest, and the remaining balance after each payment.

- Secured Loan

- An auto loan is typically a secured loan, meaning the vehicle itself serves as collateral. If you default on the loan, the lender can repossess the car.

- Upside Down (Underwater) Loan

- This occurs when you owe more on your car than its current market value. This can happen due to rapid depreciation, a small down payment, or a long loan term.

- Prepayment Penalty

- Some loan agreements include a clause that charges a fee if you pay off your loan early. Always check for this before signing.