About the Debt Snowball Calculator

What is the Debt Snowball Calculator?

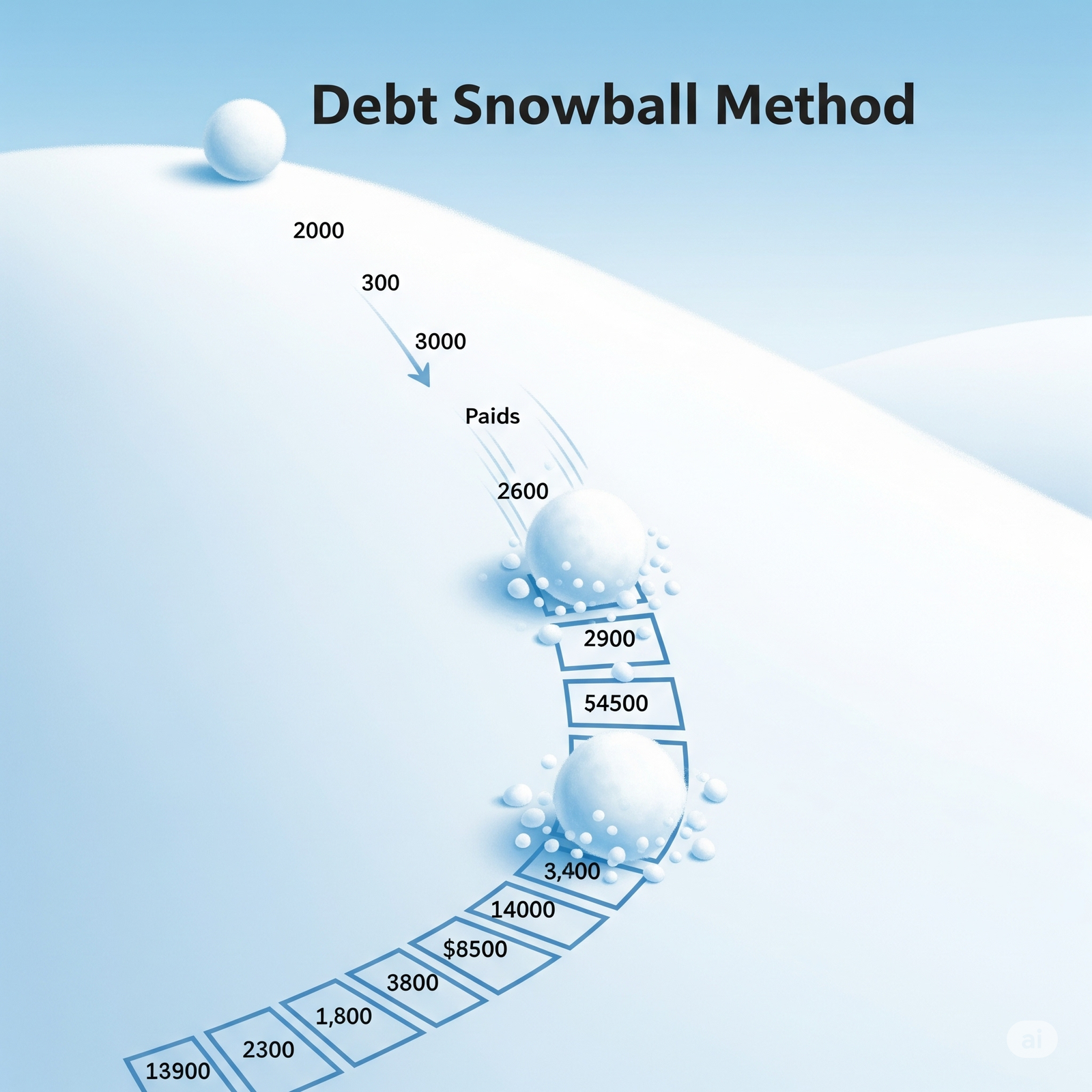

The Debt Snowball Calculator is a powerful financial tool that helps you strategically pay off your debts. This method aims to eliminate your debts one by one, starting with your smallest debt. As you pay off smaller debts, you roll the payments you were making on those debts into the next smallest debt, creating a "snowball effect" that accelerates your debt payoff process and provides psychological motivation.

The calculator helps you determine:

- Total Interest Paid: How much interest you will pay while clearing your debts.

- Total Amount Paid: The total amount you will pay to clear all your debts.

- Estimated Payoff Duration: How long it will take you to become completely debt-free.

- Payoff Schedule: A detailed monthly breakdown of when and how much each debt will be paid.

How Does the Debt Snowball Work?

The logic behind the debt snowball method is quite simple and stands out for its psychological benefits:

- List Debts: List all your debts from the smallest balance to the largest, regardless of interest rates.

- Make Minimum Payments: Make only the minimum payments on all debts except for your smallest one.

- Pay Extra on Smallest Debt: Pay as much extra as possible towards your smallest debt.

- Snowball Effect: Once your smallest debt is paid off, take the money you were paying on it (minimum payment plus any extra payment) and add it to the minimum payment of your next smallest debt. This way, your payment amount increases with each debt you eliminate, gaining momentum.

This method allows you to stay motivated by achieving small victories and makes your long-term debt-free journey more sustainable.

Key Benefits of Using the Debt Snowball Calculator

Using this calculator can provide you with several important benefits:

- Increased Motivation: Quickly eliminating small debts provides significant psychological support and motivation on your debt payoff journey.

- Clear Roadmap: Offers a clear plan on when and how to pay off your debts, reducing uncertainty.

- Financial Discipline: Develops your financial discipline by instilling the habit of making extra payments.

- Interest Savings: By paying off debts faster, you can reduce the total amount of interest paid over the long term.

- Stress Reduction: Significantly reduces your financial stress as the burden of debt decreases.

To Maximize the Power of the Snowball

To get the most out of the debt snowball method:

- Find Extra Money: Make cuts in your budget or find additional income sources to increase your extra monthly payment.

- Be Consistent: Stick to your plan and keep paying off debts, even during tough times.

- Celebrate Small Victories: Give yourself a small reward (within your budget) each time you pay off a debt to keep yourself motivated.

- Build an Emergency Fund: Building a small emergency fund before starting the debt payoff process prevents unexpected expenses from derailing your plan.