Understanding Home Equity Lines of Credit (HELOCs)

What is a HELOC?

A Home Equity Line of Credit (HELOC) is a type of loan that allows you to borrow money using your home's equity as collateral. Unlike a traditional loan that provides a lump sum, a HELOC functions more like a credit card, allowing you to draw funds as needed, up to a pre-approved limit. You only pay interest on the amount you actually borrow, not the entire approved line.

HELOCs are revolving credit lines, meaning as you pay down your balance, the available credit replenishes, allowing you to borrow again if necessary. This flexibility makes HELOCs popular for ongoing expenses, home renovations, or consolidating high-interest debt.

How a HELOC Works

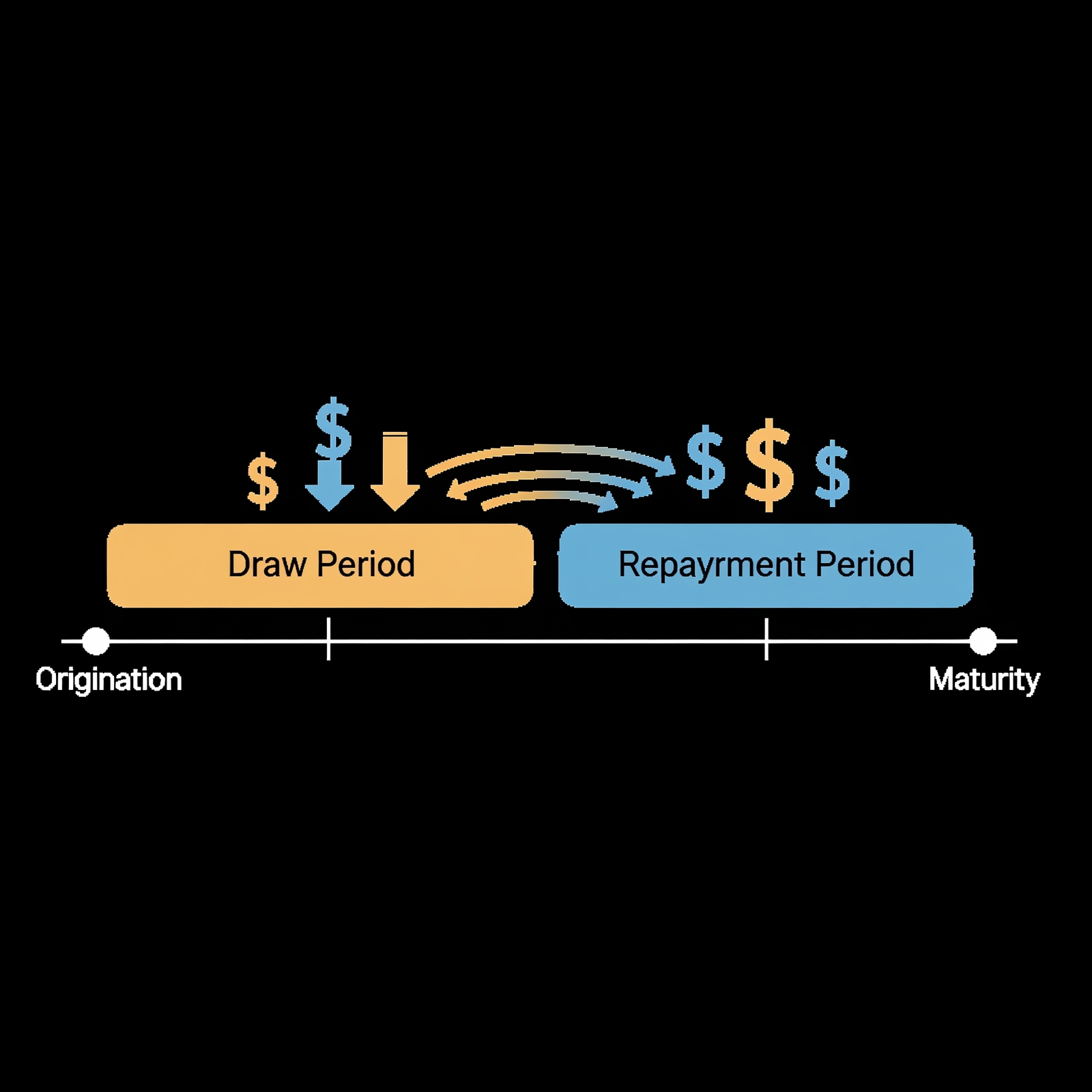

A HELOC typically has two main phases:

- Draw Period: This is the initial period, usually 5 to 10 years, during which you can access funds from your credit line. During this phase, your payments might be interest-only, or a small percentage of the principal.

- Repayment Period: Once the draw period ends, you can no longer draw funds. The balance you owe converts into a fully amortizing loan, meaning you will make regular principal and interest payments over a set period, often 10 to 20 years, to pay off the entire balance.

Interest rates on HELOCs are typically variable, meaning they can fluctuate based on market indexes, which can affect your monthly payments over time.

Benefits of a HELOC

HELOCs offer several advantages for homeowners:

- Flexibility: You can borrow what you need, when you need it, up to your credit limit, and repay it over time.

- Lower Interest Rates: Because your home serves as collateral, HELOCs typically have lower interest rates compared to unsecured loans like personal loans or credit cards.

- Potential Tax Benefits: Interest paid on a HELOC may be tax-deductible if the funds are used to buy, build, or substantially improve the home that secures the loan (consult a tax advisor).

- Versatile Use: Funds can be used for various purposes, including home improvements, education expenses, medical bills, or debt consolidation.

Risks and Considerations

While beneficial, HELOCs also come with risks:

- Variable Interest Rates: If market rates rise, your monthly payments can increase significantly during both the draw and repayment periods.

- Foreclosure Risk: Since your home is collateral, defaulting on your HELOC payments could lead to foreclosure.

- Balloon Payments: Some HELOCs may have a large balloon payment due at the end of the draw period if only interest payments were made.

- Home Value Fluctuations: A decline in your home's value could reduce your available credit or even lead to your lender freezing or reducing your credit line.

HELOC vs. Home Equity Loan

It's important to distinguish a HELOC from a Home Equity Loan:

| Feature | HELOC (Home Equity Line of Credit) | Home Equity Loan |

|---|---|---|

| Structure | Revolving credit line (like a credit card) | Lump-sum disbursement |

| Interest Rate | Typically variable | Typically fixed |

| Access to Funds | Draw funds as needed over a period | Receive all funds at once |

| Payment Type | Interest-only during draw period, then P&I | Fixed principal and interest payments from the start |