Understanding Inflation and Its Impact on Your Money

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in the purchasing power of money over time. This means that the same amount of money will buy fewer goods and services in the future compared to today. Understanding inflation is essential for effective financial planning and preserving your wealth.

The Inflation Impact Calculator helps you estimate how inflation can affect the value of your money over a specific period. By entering the current amount, the expected inflation rate, and the number of years, you can see how much your money will be worth in the future after adjusting for inflation.

This calculator provides insight into how inflation erodes the real value of savings, investments, and future income. For example, if inflation averages 3% annually, something that costs $100 today may cost around $134 in ten years. By factoring inflation into your financial goals, you can make more realistic plans for retirement, investments, and budgeting.

The calculator also helps you understand the importance of investing in assets that have the potential to outpace inflation, such as stocks or real estate. Simply saving money without considering inflation may lead to a loss in purchasing power over time.

Whether you are saving for retirement, planning a major purchase, or managing daily expenses, this Inflation Impact Calculator is a valuable tool. It encourages you to think critically about how inflation affects your financial future and the steps you can take to protect your wealth.

Use this tool to explore different inflation rates and time horizons to see how small changes can significantly affect your money’s value. With this knowledge, you can make informed decisions to maintain your financial health despite rising costs.

Deeper Dive into Inflation Concepts

Inflation is a complex economic phenomenon influenced by various factors. Understanding its different forms and underlying causes is crucial for a comprehensive financial outlook.

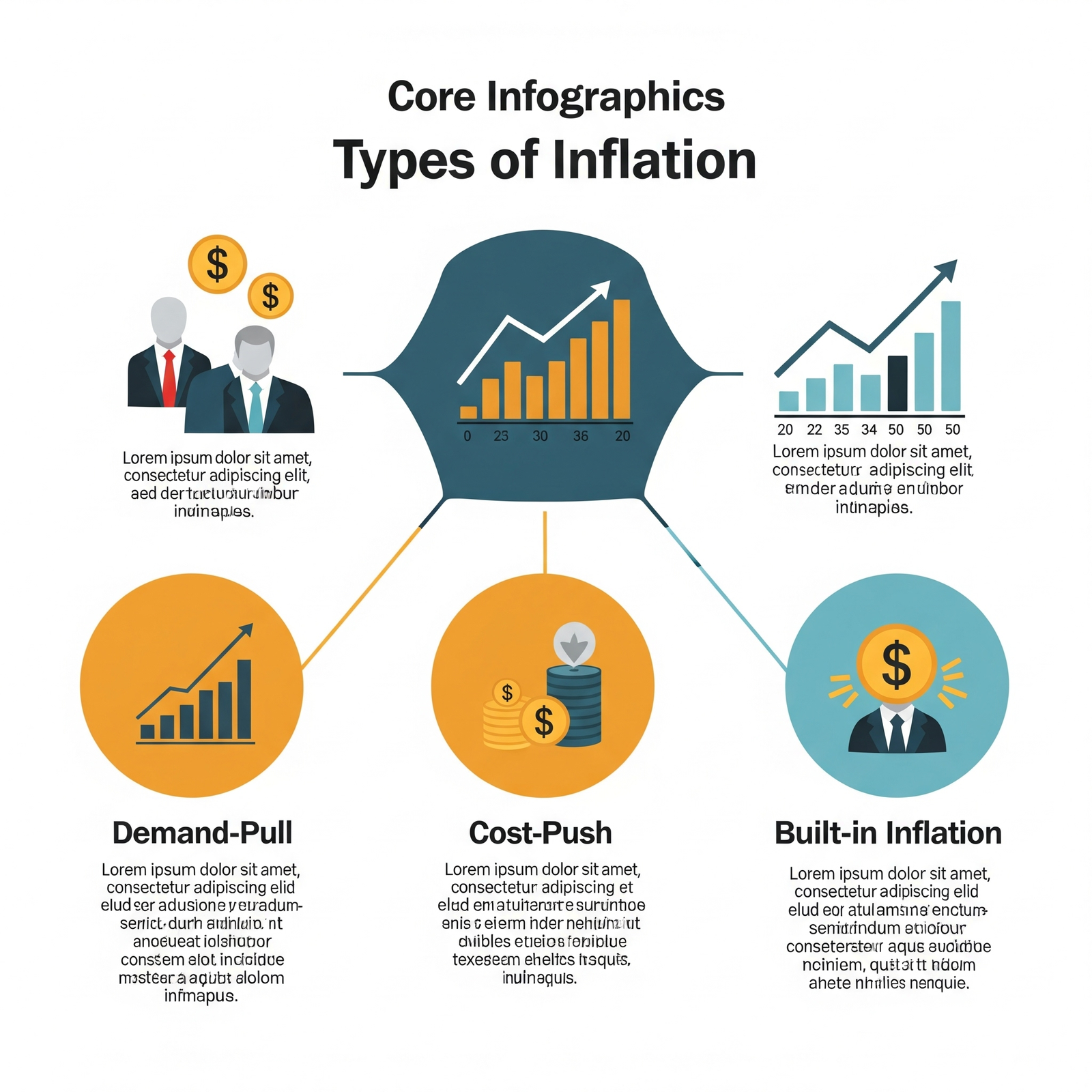

Types of Inflation:

- Demand-Pull Inflation: Occurs when aggregate demand in an economy outpaces the available supply of goods and services. Too much money chasing too few goods leads to higher prices.

- Cost-Push Inflation: Arises when the cost of producing goods and services increases, forcing businesses to raise prices to maintain profit margins. This can be due to rising raw material costs, wages, or energy prices.

- Built-In Inflation (Wage-Price Spiral): This type of inflation occurs when workers demand higher wages to compensate for rising prices, and businesses, in turn, raise prices further to cover the increased labor costs. This creates a self-perpetuating cycle.

Causes of Inflation:

Beyond the specific types, several broader factors contribute to inflationary pressures:

- Government Spending and Fiscal Policy: Large government spending, especially when financed by borrowing or printing money, can inject too much money into the economy, leading to demand-pull inflation.

- Monetary Policy: Central banks' decisions on interest rates and money supply significantly impact inflation. Lower interest rates encourage borrowing and spending, potentially fueling inflation, while higher rates can curb it.

- Supply Chain Disruptions: Events like natural disasters, pandemics, or geopolitical conflicts can disrupt global supply chains, leading to shortages and increased production costs, thus contributing to cost-push inflation.

- Global Events: International events, such as oil price shocks or trade wars, can have widespread effects on domestic prices.

Example: Visualizing different inflationary pressures.

Example: Visualizing different inflationary pressures.

Detailed Impact on Different Financial Aspects

Inflation doesn't affect all financial aspects equally. Understanding its varied impact is key to proactive financial management.

Impact on Savings:

Perhaps the most straightforward impact of inflation is on your cash savings. If your savings account interest rate is lower than the inflation rate, your money is effectively losing purchasing power. For instance, if you have $10,000 in a savings account earning 1% interest, and inflation is 3%, your real return is -2%, meaning your money buys less each year. This highlights the importance of investing rather than merely saving.

Impact on Investments:

- Stocks: Companies with strong pricing power and stable demand can often pass on increased costs to consumers, making their stocks more resilient to inflation. However, high inflation can also lead to higher interest rates, which can negatively impact growth stocks.

- Bonds: Fixed-rate bonds are generally vulnerable to inflation because the fixed interest payments become less valuable in real terms. Inflation-indexed bonds (like TIPS in the US) are designed to protect against this by adjusting their principal value based on inflation.

- Real Estate: Real estate often acts as an inflation hedge because property values and rental income tend to rise with inflation. However, rising interest rates can also increase mortgage costs, affecting affordability.

- Commodities: Raw materials like gold, oil, and agricultural products often perform well during inflationary periods as their prices tend to rise with general price levels.

Impact on Retirement Planning:

Retirement planning is particularly susceptible to inflation's long-term effects. A comfortable retirement lifestyle planned for today's costs will be significantly more expensive decades from now. This means you need to save more than you might initially anticipate and invest in assets that offer inflation-adjusted returns to ensure your retirement savings maintain their purchasing power.

Impact on Purchasing Power:

This calculator directly illustrates the erosion of purchasing power. Consider a basket of groceries that costs $100 today. If inflation is 3% annually, that same basket will cost approximately $103 next year, $106.09 the year after, and so on. Over longer periods, this compounding effect dramatically reduces what your money can buy.

Impact on Debt:

Inflation can have a mixed impact on debt. For those with fixed-rate debt (like a traditional mortgage), inflation can effectively reduce the real value of their payments over time, making the debt easier to repay with inflated future dollars. However, for new borrowers, high inflation often leads to higher interest rates, making new loans more expensive.

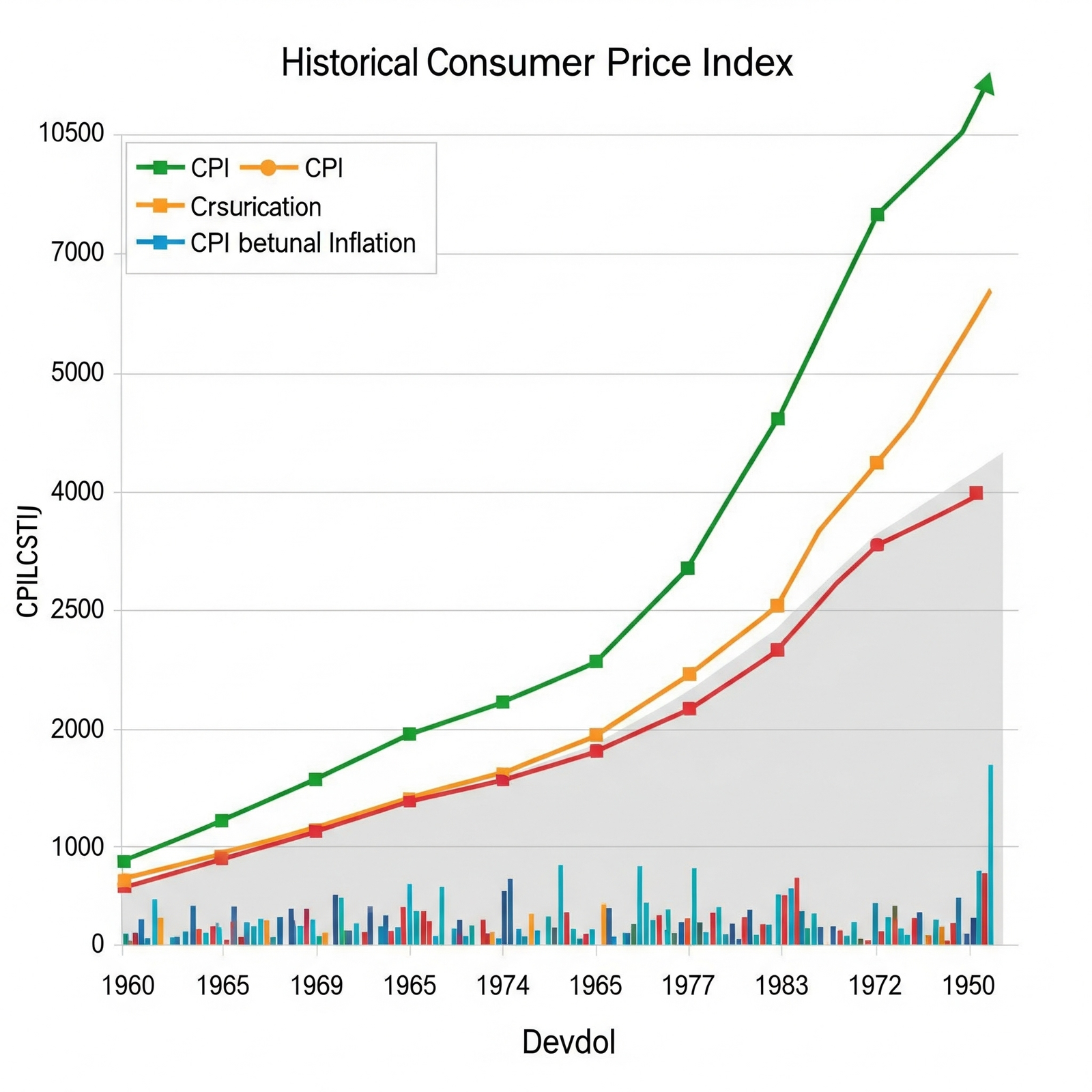

Example: Historical inflation trends and their impact.

Example: Historical inflation trends and their impact.

Strategies to Combat Inflation

While inflation is a natural part of economic cycles, there are proactive steps you can take to mitigate its negative effects on your finances.

- Diversified Investing: Don't keep all your money in cash. Invest in a diversified portfolio that includes assets like stocks, real estate, and commodities that tend to perform well during inflationary periods.

- Inflation-Indexed Securities: Consider Treasury Inflation-Protected Securities (TIPS) which adjust their principal value in response to changes in the Consumer Price Index, offering protection against inflation.

- Real Estate: Owning real estate can provide a hedge against inflation, as property values and rental income typically rise over time.

- Review and Adjust Your Budget: Regularly review your budget to account for rising costs. Look for areas where you can cut expenses or find more cost-effective alternatives.

- Seek Income Growth: Ensure your income grows at least at the rate of inflation. This might involve negotiating for salary increases, seeking additional skills, or exploring supplementary income streams.

- Minimize Cash Holdings: While an emergency fund is essential, keeping excessive amounts of cash in low-interest savings accounts can lead to a loss of purchasing power over time.

Example: Strategies for safeguarding your wealth from inflation.

Example: Strategies for safeguarding your wealth from inflation.

Long-Term Perspective: The Cumulative Effect of Inflation

It's easy to underestimate the power of inflation, especially when it's at a seemingly low rate. However, over decades, even a modest annual inflation rate can drastically reduce the purchasing power of your money. The compounding effect means that each year, the erosion builds upon the previous year's loss. This calculator is a powerful tool to visualize this long-term impact, encouraging a forward-thinking approach to your financial planning. By understanding how seemingly small percentages accumulate over time, you can set more realistic financial goals for retirement, education, or any other long-term aspiration.